Dan and Sephana were about to graduate from high school. They lined up in their gowns, lining up, to walk up the stage and receive their diploma. Though their lives, and their parents’ lives, had winded through different paths, they had a similar dream. They imagined that if they study hard at university and become a successful professional, they can have a comfortable middle-class life. They can own a home where they can watch their children grow.

Ten years later, Dan has become a brilliant engineer and Sephana a caring nurse. They got the education, the job, even a beautiful daughter named Eliza. But they did not get the house. Most of their income is swallowed by the high price of rent, food, daycare, fuel, and tax. Their meager savings will take twenty years to be sufficient for a simple home. By that time, prices will probably have quadrupled; which makes their savings irrelevant, they figure.

Dan, Sephana, and Eliza may be fictional characters, but their dreams are very real. This is the same dream for forgotten professional middle-class people.

Middle-class and down payments

The median household income in Metro Vancouver is $81,937. It is estimated that with a 10% down-payment, and no other debt, a middle-class household may purchase a home up to $460,000. At this price, it would only be possible to purchase an apartment in one of eight municipalities surveyed below, namely Port Coquitlam. If the household is able to have a 20% down payment, then she may afford to purchase an apartment in six of the municipalities surveyed below including Burnaby, Coquitlam, Port Coquitlam, Port Moody, North Vancouver, and Richmond (see below).

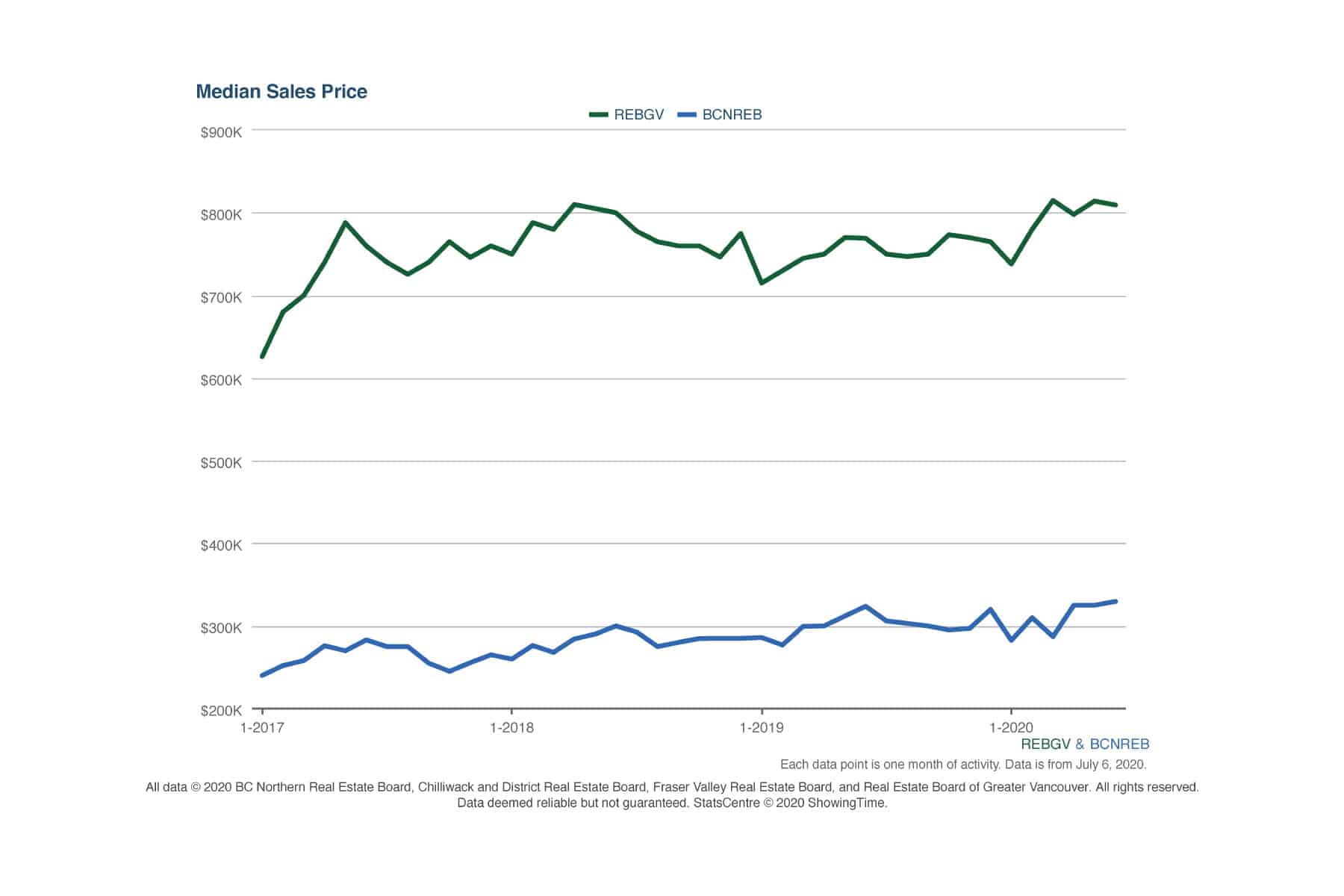

Moreover, while household incomes have stagnated for renters in Metro Vancouver since 2006, apartment prices have more than doubled in the same period. This trend is likely to continue, as there’s a lack of investments in infrastructure, healthcare, and manufacturing that would prohibit job and wage growth.

However, the challenge is the 20% down-payment. Canadian households save about 3% of their income (Statistics Canada). This figure would be lower for Metro Vancouver, as the cost of living, food, and fuel is one of the highest in Canada. So at 3% saving rate, it will take a middle-income family about 56 years to save enough for that down payment. Unfortunately, waiting for 56 years is not the biggest challenge. The largest challenge is that, if real estate prices of the last 50 years are an indication, in 56 years apartment prices will be seven times higher than they are today. That would make the middle-class savings for down-payment insufficient.

Vancouver is not the only one with a forgotten middle-class

The story of Vancouver housing prices slipping out of the local population’s reach is not unique. Many other cities around the globe have faced a similar challenge in the past century. New York, London, Hong Kong, Singapore, Sidney, and San Fransisco can serve as relevant examples. As such, there exists a variety of policies and programs that have been applied to virtually the same challenge. Success of such measures varies considerably. More interestingly, it is possible to assess the efficacy of these measures in a wide range of political structures from communism to liberal democracy.

The common thread is that the economic success of cities becomes its housing curse. Throughout history, independent of time and geography, when a city becomes prosperous it provides more jobs and opportunities. As such it attracts workers from nearby villages, towns, cities, and countries. This increase in population will demand housing. As such, if population growth exceeds the rate of new housing developments, larger groups of people have to compete for a restricted inventory of housing, that drives up the price. Furthermore, in such successful cities the land prices naturally due to her stability, desirability, and opportunities.

For instance, real estate prices for northern BC have been almost a third of the Lower Mainland as far back as 2005. If the price was the main concern, then one would expect for people to move where houses are priced at a third. However, the reality is that people want to be as close to where jobs, opportunities, education, and entertainment are as possible. That in turn drives up the land value of that city.

Source: Real Estate Board of Greater Vancouver

Source: Real Estate Board of Greater Vancouver

In 2019, immigration to BC consisted of 9,551 persons from other Canadian provinces, and 64,441 internationally. BC’s natural population growth began decreasing in 1993. This has been primarily due to lower birth rates and the aging population. BC Statistics estimates that by 2035 BC natural population growth will become negative. That is as to why the liberal immigration policies will persist to meet the workforce demand of a prosperous city.

Metro Vancouver is compromised of 21 different municipalities. Each municipality votes a new council and mayor every four years. Municipal zoning, and housing, policies can become the complete opposite of their predecessors. This was evident in the 2018 election across many municipalities. As such, metro Vancouver can face 21 divergent municipal policies that can change every four years. A bigger challenge, common among liberal democracies, is the short-term vision on winning elections by whatever means. The larger fundamental problems of housing, infrastructure, education, and healthcare are continuously left for next elected officials, or next-generation, to deal with.

Hence, a complete transformation like Singapore may not be possible in fragmented municipal, and ever-changing policies of liberal democracy. However, there is hope. There are examples of small scale projects that have proven to work even within such systems. A few examples are illustrated below.

London Living Rent

London Living Rent is a type of affordable housing for middle-income Londoners. These homes will have lower rents, so the cash you save on rent can go towards a deposit for your own home. This is part of Homes for Londoners, which brings together all of the Mayor’s work to address the housing crisis. Most London Living Rent homes will be built using funding from our Affordable Homes programme and be available by 2021. This is a part-buy part-rent product for those taking their first step onto the property ladder. London Living Rent homes are for middle-income households who now rent and want to build up savings to buy a home. This can be either through shared ownership or outright purchase. Landlords are expected to encourage their tenants into home ownership within 10 years. The homes will be offered on tenancies of a minimum of three years. Tenants will be supported to save and given the option to buy their home on a shared ownership basis during their tenancy. They will also be given extra priority for other shared ownership homes across London. To be eligible applicants must be renting in London, have a maximum household income of 60,000 pounds, and be unable to currently buy a home in their local area.

San Francisco

Union Home ownership Investors double a homebuyer’s down payment in return for a share of the property – typically 35% – which is cashed in at the time of resale. Buyers can choose to buy out the amount provided by Unison after three years on the basis of an independent appraiser’s valuation.

Fernie, BC

Fernie, BC provides a closer example to home. Opening in 2012, Veneto Place was BC Housing’s first public-private partnership offering 45 units with market, below-market rental, rent-to-own, and attainable ownership options. The total capital cost of 45-unit development, including 12 SRH units was approximately $7 million. Various public and private entities contributed to the project including the project developer, the private owner who sold the land at a price below market value for affordable cause, City of Fernie, Columbia Basin Trust, Canadian Mortgage and Housing Corporation (CMHC), and East Kootenay Community Credit Union.

BC and Canada Government

BC and Canada Government have partnered on the $123.6 million Seniors’ Rental Housing initiative to create 1,000 new affordable housing units for seniors and persons with disabilities in 40 communities across B.C. The initiative was designed to help stimulate local economies in smaller communities. It had created close to 800 jobs by the end of 2011. Through innovative partnerships with non-profit housing societies, nearly 1,200 new units have been created. Twelve of Veneto Place’s 45 units were built with funding from this initiative.

3000 Henry, Port Moody

3000 Henry, Port Moody is a rare and innovative project in Metro Vancouver that seeks to utilize private and public partnerships to address the affordability for middle-income families. This project is a unique application of the Rent-to-Own (RTO) program.

3000 Henry RTO model proposes to do the following. In the beginning, the prospect would check with their bank to see if they qualify for the RTO program. A small deposit of $5,000 is paid upfront. Then they pay market rent for two years. At the end of the two-year term, all the paid rent will get credited towards the purchase of the home. Additionally, the developer will pay all property tax and insurance during that two-year period. The savings from rents, and the time-value of the deposit that is paid two years later, can add up to 7.2% of the purchase price.

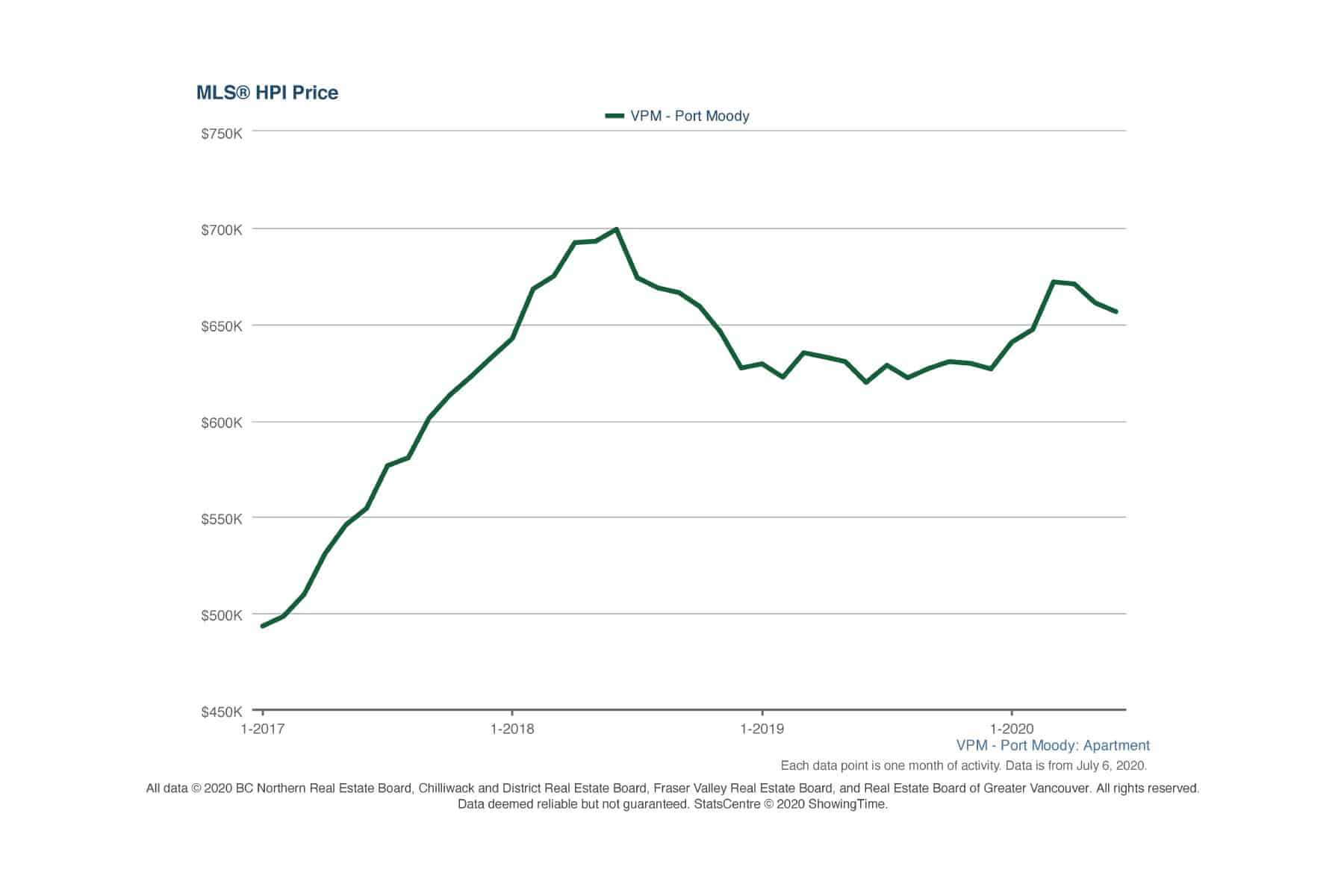

Lastly, the purchase price is negotiated and fixed at the beginning of the term. This solves the challenge of home prices appreciating much faster than the middle-class can save money. For instance, apartment prices in Port Moody have increased by 103% over the past years (see below). That is an average of 10.3% per year. That means through this RTO model, the prospects may get a 20.6% discount, should prices appreciate similar to the past decade.

Source: Real Estate Board of Greater Vancouver

Source: Real Estate Board of Greater Vancouver

On the financing side, because of this RTO program, prospects may be enabled to take on conventional mortgages of 20% down payment. As such they would not have to pay the additional 3% mortgage insurance for down payments less than 10%.

Thus, through this unique RTO program prospects may get a nearly 30% discount on purchasing their home after two years. That is astonishing and urgently needed. It must be noted that each developer creates and offers its own RTO program. For instance, in many programs, the rent does not get credited towards the purchase price. As such, the 3000 Henry proposal is very generous.

At the end of two-year term prospects are not obliged to purchase the units. They can simply walk away, forfeiting their small deposit of $5,000. However, it is difficult to imagine how one can simply walk away from all such benefits and limited alternatives.

These families will have an opportunity to settle in their neighbourhood long before they must commit to purchasing. Moreover, these families will vacate rental units that are desperately needed across Metro Vancouver.

This Rent-to-Own program has the prospect of building a bridge for middle-class renters to become homeowners. Once built and implemented, it can serve as a successful model to enable the forgotten middle-class towards homeownership.

You might also like

About Aultrust Financial

Aultrust is a financial and real estate development organization, combining finance with development to help build distinctive communities. Aultrust takes its name from a deep-rooted conviction to principles of integrity, good-will, and social responsibility.

Shall you have any questions regarding the above, please reach out to us by filling in the form below.